salt tax deduction calculator

Also known as the SALT. Comments and suggestions.

The Tax Cuts And Jobs Act What Does It Mean For Medical Residents

Cookies are required to use this site.

. Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022. Hamilton County collects on average 153 of a propertys assessed fair market value as property tax. Your total deduction for state and local income sales and property taxes is limited to a combined total deduction of 10000 5000 if married filing separately.

You can only claim the state and local tax deduction if you itemize deductions on your tax. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. Sales and local taxSometimes referred to as SALT state and local tax this federal deduction can be either income tax or sales tax but not both.

You use HELOCs or home equity loans to pay for home improvements. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. A big itemized deduction for many taxpayers is the state and local taxes SALT deduction.

SALT If any of these situations apply it is easy to take some deductions from the taxes that you have to pay. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The deduction for state and local taxes is no longer unlimited.

2021 Tax Deduction Limits. This calculator is for 2022 Tax Returns due in 2023. At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return.

We welcome your comments about this publication and suggestions for future editions. Therefore if 15 of. Starting with the 2018 tax year the maximum SALT deduction available was 10000.

NW IR-6526 Washington DC 20224. This is currently capped at 10000 per year for most taxpayers as a result of the Tax Cuts and Jobs Act. In 2021 and 2022 this deduction cannot exceed 10000.

The median property tax in Hamilton County Ohio is 2274 per year for a home worth the median value of 148200. Mortgage Tax Benefits Calculator. Your browser appears to have cookies disabled.

In prior years taxpayers who itemized on their federal income tax return could deduct amounts paid for state and local income or sales and property taxes in full. 2022 Marginal Tax Rates Calculator. See what other deductions changed in 2018 How to claim the SALT deduction on your 2021 taxes.

Your household income location filing status and number of personal exemptions. SALT deduction New York. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

Depreciation under the Income Tax Act is a deduction allowed for the reduction in the real value of a tangible or intangible asset used by a taxpayer. This is an amount that you deduct right off the top just for being a. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR.

The capital gains tax rate is 15 if youre married filing jointly with. The deduction was unlimited before 2018. Salt works condensers reservoirs salt pans etc made of clayey sandy or earthy material or any other similar material.

Taxpayers who live in states that dont have an income tax are probably better off using their sales tax for the deduction. Enter a high Deduction amount here and click Estimate until WPRO-17 below shows 0 or the same as in WPRO-12 see above. For example say you paid 7000 in state income taxes and 5000 in property taxes in 2021.

Selling rental properties can earn investors immense profits but may result in significant capital gains tax burdens. This cap applies to state income taxes local income taxes and property taxes. State and local taxes SALT The preceding list may be daunting but rest assured collecting all this information beforehand will save a lot of grief when it comes time to sit down and fill out your tax forms.

State and Local Tax SALT Deduction limit goes into effect in 2018. Hamilton County has one of the highest median property taxes in the United States and is ranked 332nd of the 3143 counties in order of median property taxes. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

Currently the IRS limits your total state and local tax deduction to 10000. WPRO-17 Enter an estimated deduction amount here and click EstimateStart with 10000 and click Estimate to adjust the deduction dollar amount until it matches or comes close to the amount in WPRO-12. The deduction has complicated rules but essentially you must deduct the proportion of your mortgage that is equal to the proportion of the space you use for your work.

Use our Tax Calculator software claim HRA check refund status. The new tax law also ended the deduction for interest on home equity indebtedness until 2026 unless one condition is met. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

What Is The Salt Tax Deduction Forbes Advisor

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

How Does The Deduction For State And Local Taxes Work Tax Policy Center

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

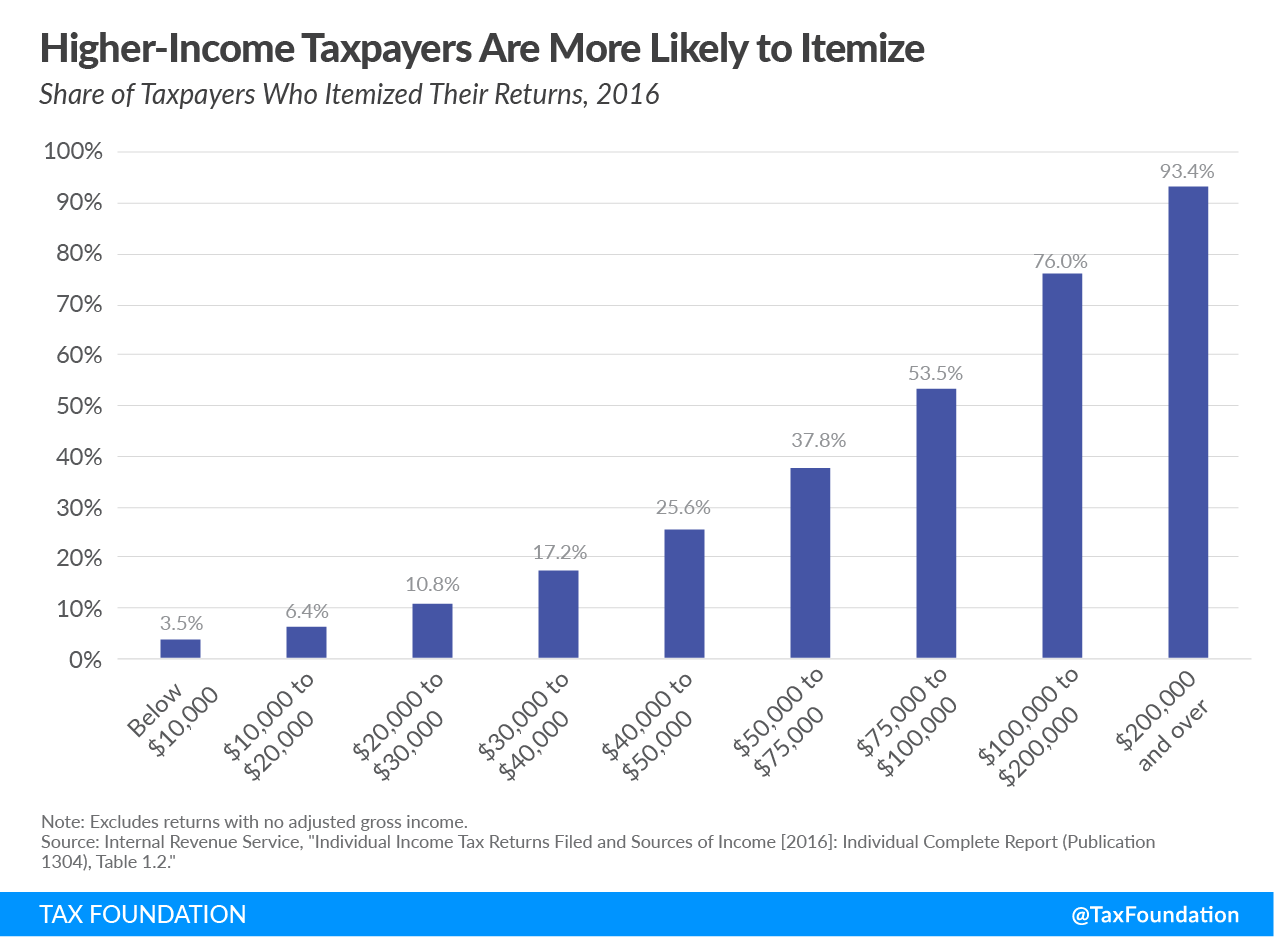

Itemized Deduction Who Benefits From Itemized Deductions

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

What Are Itemized Deductions And Who Claims Them Tax Policy Center

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy